The 7-Minute Rule for Ach Processing

Throughout the years, the globe of financial has changed significantly as well as has worldwide influenced countless people. During this age of advancement, rather of paying by cash, checks, credit score or debit card, the settlement process has actually evolved right into quicker, much safer as well as more effective digital methods of moving money. Automated Clearing Up House (ACH) has actually made this possible.

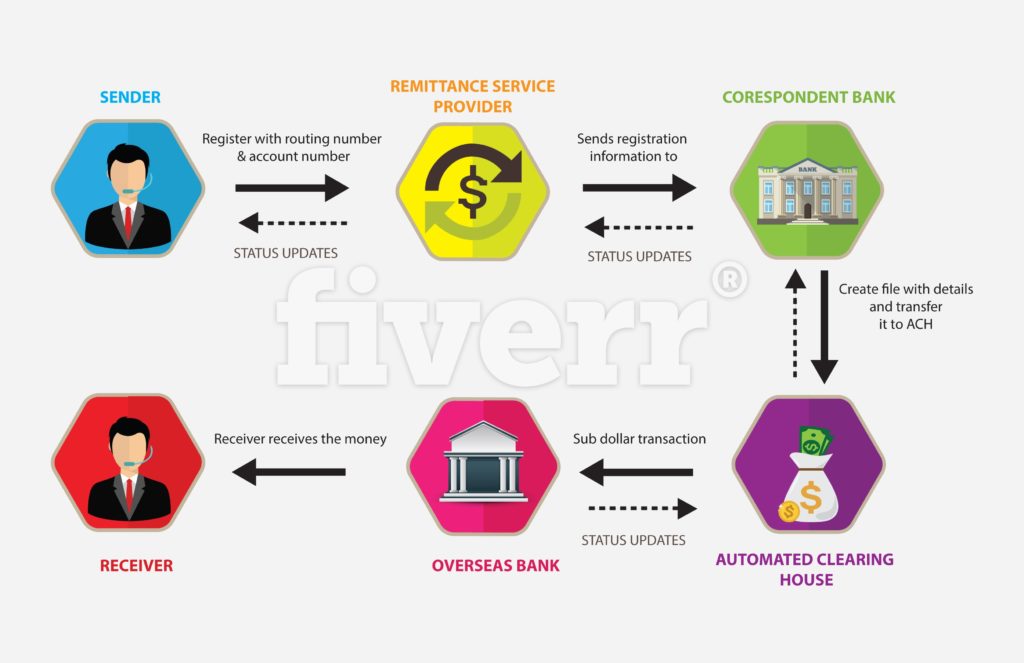

There are two major categories for which both customers as well as services use an ACH transfer. Straight payments (ACH debit deals) Straight deposits (ACH debt purchases) Some economic institutions also offer expense settlement, which permits users to set up and also pay all costs digitally making use of ACH transfers. Or you can use the network to initiate ACH transactions in between individuals or vendors abroad.

An ACH repayment is made through the ACH network, instead than going via the major card networks like Visa or Mastercard.

Some Known Incorrect Statements About Ach Processing

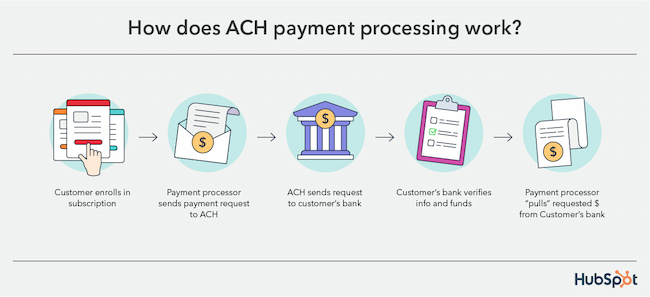

An ACH debit deal does not involve physical paper checks or debit card. To initiate a deal with ACH, you'll need to accredit your biller, such as your electric company, to draw funds from your account.

You can likewise set up a web link in between your biller and also your bank account without accrediting automated payments. This offers you higher control of your account, allowing you to send repayment funds only when you especially enable it.

It moves cash from the company's bank account to an employee's in a simple and also relatively inexpensive means. The company just asks their monetary establishment (or pay-roll business) to advise the ACH network to pull cash from their account and i loved this down payment it as necessary. ACH down payments allow people to start down payments elsewherebe that a bill payment or a peer-to-peer transfer to a friend or proprietor.

Ach Processing for Dummies

An ACH straight payment supplies funds right into a checking account as credit score. A straight deposit covers all sort of down payment payments from organizations or government to a consumer. This includes federal government benefits, tax as well as various other refunds, and annuities as well as passion settlements. When you obtain settlements with straight down payment with ACH, the advantages include ease, less charges, no paper checks, as well as quicker tax obligation reimbursements.

The number of debit or ACH credit ratings processed each year is continuously boosting. In 2020, the ACH network refined monetary purchases worth more than $61.

The 5. 3 billion B2B paymentsvalued at $50 trillionreflect a 20. 4% increase from 2020, as the pandemic fast-tracked services' switch to ACH settlements. Over simply the past 2 years, ACH B2B settlements are up 33. 2%. An ACH credit report entails ACH transfers where funds are pressed into a financial institution account.

For instance, when a person establishes a repayments with their financial institution or credit report union to pay expenses from their nominated checking account, these payments would be processed as ACH credits. ACH debit deals entail ACH transfers where funds are pulled from a savings account. That is, the payer, or customer gives the payee consent to total repayments from their nominated bank account whenever it comes to be due.

Ach Processing Things To Know Before You Get This

ACH as well as credit scores card payments both web allow you to take repeating settlements simply and also quickly. Nonetheless, there are 3 primary differences that it may be valuable to highlight: the assurance of repayment, automated cleaning house processing times, and fees. When it concerns ACH vs. charge card, the most essential distinction is the warranty of settlement.